We’re kicking off the home stretch of season 2 by delving into home bias (see what I did there!?). But while we’re spending time focusing on home bias, what we’re really excited about is looking at some new research which can aid you in managing your own biases. We’ll be chatting to a PhD-graduate, Dr Shreeya Jugnandan. She developed a framework to do exactly this (help you) by conducting some pretty compelling research in the area of mitigating bias.

If you haven’t done so yet, please subscribe to our channel so you always have the latest insights. If you’re more of the “sit in the car and listen to a podcast” type, then feel free to listen to this episode.

It’s fairly easy to work out what home bias is – basically you prefer things that are closer to home. In investment terms, you can see this bias play out in people who prefer to invest in domestic assets over foreign ones.

Home bias might seem innocuous at first glance, but it’s implications can be profound. Share on XInvesting locally is great, yes. But ONLY investing locally can lead to a lack of diversification in your portfolio, and diversifying across international opportunities is often advantageous.

So, why do we have home bias, or fall prey to it? Home bias stems from familiarity bias… relying on familiar information when making a decision. So… you always order the same dish at a restaurant, always shop at the same supermarket, always use the same brands over and over. This bias stems from availability bias, where we gravitate towards what we know and recent events influence our perceptions.

A major problem with home bias is how easy it is to get into a feedback loop. The media can play into this bias, exacerbating it in many ways. Local news is a big player here. Watch this snippet where we share a research study on this (or read more here).

The biggest risk is not the market risk. It’s the risk of not understanding your own biases.

Another particularly bad case of home bias is when you’re over invested in your employer. We also chat about this unconscious bias in the workplace. That’s probably the biggest risk we want to draw your attention to. Please watch that snippet, or go read about it here.

Dr Shreeya Jugnandan’s research aimed to quantify the presence of home bias in the South African market. Understanding that would then aid the development of a framework to mitigate the impact of biases, generally.

Through meticulous analysis, preliminary evidence of significant home bias was revealed, with a disproportionate amount of assets invested locally. Such concentration poses risks, as it may overlook global opportunities and hinder portfolio growth.

But let’s start at the beginning and hear what it was that she was originally setting out to do when she first registered for her PhD.

…I think at the heart of this thesis was trying to help people, trying to help people manage their behavioural biases, trying to prevent the layman, the individual investor from falling prey to these vicious behavioural biases. So, inherently a bit of altruism there with a huge goal, right? Trying to solve important problems by mitigating behavioural biases.

It was quite the ambitious study. Of course, when doing research, you can’t just run off and assess how we manage a bias, we first have to prove that it exists. Shreeya shares what she did to assess whether home bias existed in the South African market or not.

What we went about doing was actually trying to quantify some back-of-the-envelope calculation, some high-level data triangulation as to whether or not there was this concentration of investment locally by South Africans. In other words, over weighting South African investments relative to where South Africa sits on a global scale. So, like your optimal portfolio weightings for countries.

We looked at the coordinated portfolio investment survey. That survey basically helps us understand where assets sit around the world. So how much of South African assets are invested in other countries and how much of other countries’ assets are invested in South Africa.

And that optimal weighting was basically done looking at the overall contribution of each country’s market cap to the global market capitalisation. So, it’s a weighting exercise. How much is out? How much is in? And comparing that to a so-called optimal weighting.

Quite technical, but this is what you need to do with robust research.

Let’s consider what that ratio showed.

Firstly, we did find preliminary evidence of home bias. We did find a large concentration of assets remaining sort of onshore, remaining within South Africa. And that was very disproportionate to South Africa’s contribution to the global GDP.

In other words, we had people investing a lot in a country that doesn’t have a lot of power when it comes to global markets, which is concerning, right? And that’s at the heart of home bias and why home bias is problematic for various other reasons.

Almost on a, I guess, on a rudimentary scale, if we wanted to quantify the strength of home bias, we found around 55 to 60% of assets actually sitting locally…

Let’s consider where the remaining 35% to 45% was going…

Some of the results were largely unsurprising. So, I think a lot of South Africans love the United Kingdom. I know we see a lot of people planning to immigrate to the UK. I’m sure after the rugby, I wonder if they’re thinking twice about that. But basically, what we found there is that a lot of foreign investment was sitting in the United Kingdom, as well as some very strong offshore tax havens. So, you’re looking at low tax countries like Ireland, obviously some investments sitting in Guernsey, Bermuda, those tax havens, so to speak.

And I guess some of that is sensible, right? So, if you’re going offshore, you want to make sure you’re doing it in the most tax efficient method possible, hence explaining those offshore financial centers like Ireland and those very fascinating islands, so to speak.

And the other link to it, I guess, is the United Kingdom. So, what’s the big deal with the United Kingdom? …And I think there are some common links from a financial services perspective. Like if you think about some of our local banks here in South Africa, tending to have strong connections to the UK. …On the other hand, thinking about things from a juristic perspective, where some banks may actually have parent companies sitting within the United Kingdom. So, looking at some social and economic entrenchment relationships between South Africa and the UK.

Then things got a little more interesting when Shreeya went out and interviewed financial planners, to get their views on the prevalence of home bias with their clients.

The conversations with financial planners shed light on the complexities surrounding home bias. Despite clients expressing a desire to invest offshore, emotional attachments and lifestyle considerations often tether their assets to South Africa.

What came out of that [the interviews with financial planners] was probably one of the most interesting parts of my research…

There was this really fascinating trend or disconnect between where South Africans want to live compared to where they want to invest their money. So, a lot of the planners I spoke to actually experienced people seeking them out. “Please help me take my money offshore.” “Please help me invest outside of South Africa.” And it tended to be accompanied by negative sentiments… people tended to have a negative outlook on the country. South Africa from a socio-political perspective, people are upset about what they’re seeing on the news. People are really influenced by talking to their peers and they tend to get into a negative mindset about the country in and of itself. And they think to remedy that ill-ease, they want to send their money offshore as fast as possible in the most efficient way possible.

Then the conversation gets even more interesting…

Success in investing doesn’t correlate with IQ … what you need is the temperament to control the urges that get other people into trouble in investing.

The next part of the conversation tended to be the financial planner challenging the client. “So, you want to move such a large amount of your wealth offshore. What about liabilities matching? You know, you’re going to incur costs, you have existing debt in South Africa. Why don’t you just go ahead and emigrate? You know, cut ties, just move overseas if you’re so unhappy with South Africa.” And then many South Africans actually said “no”.

People don’t want to compromise their lifestyle here. You know, we live in Cape Town, we’ve got these beautiful mountains, the beach, excellent weather. People don’t wanna leave South Africa, but they want to send their money offshore. So, this interesting tension between desired investment outcomes and where they’re actually living.

The mismatch between investment goals and geographical preferences underscores the need for nuanced strategies in bias mitigation.

Some of the wealthy clients had income generating assets here in South Africa. So, a lot of their wealth was rooted in businesses they had started up here, you know, maybe a portfolio of investment properties and feeling a sense of discomfort with actually liquidating those assets and sending it offshore. So also, some emotional attachments to legacy assets that they were reluctant to liquidate.

Let’s quickly summarise. Home bias is apparent. Obviously, we need to remember that the financial planners Shreeya spoke to are dealing with a certain subset of the market, but the data did show that there’s an over-concentration of investments locally.

But then, what the conversations with the planners did enlighten her on was that while their clients weren’t necessarily unwilling to invest more offshore, the challenge actually came where there was a mismatch between where they wanted to live and where they wanted to retire versus where they needed to put their assets, which should be matching.

I think it’s a “watch out for” as well, or maybe a contributor to our preliminary statistics as well, right? Because you have this capital that you’ve invested in South Africa, that’s your root base, your generation of wealth, and that just stacks up in the big picture. So, I think to wrap up, when thinking about onshore, offshore, it’s always important to do a good stand back test. Where am I living? Where am I working? And where’s my money going accordingly?

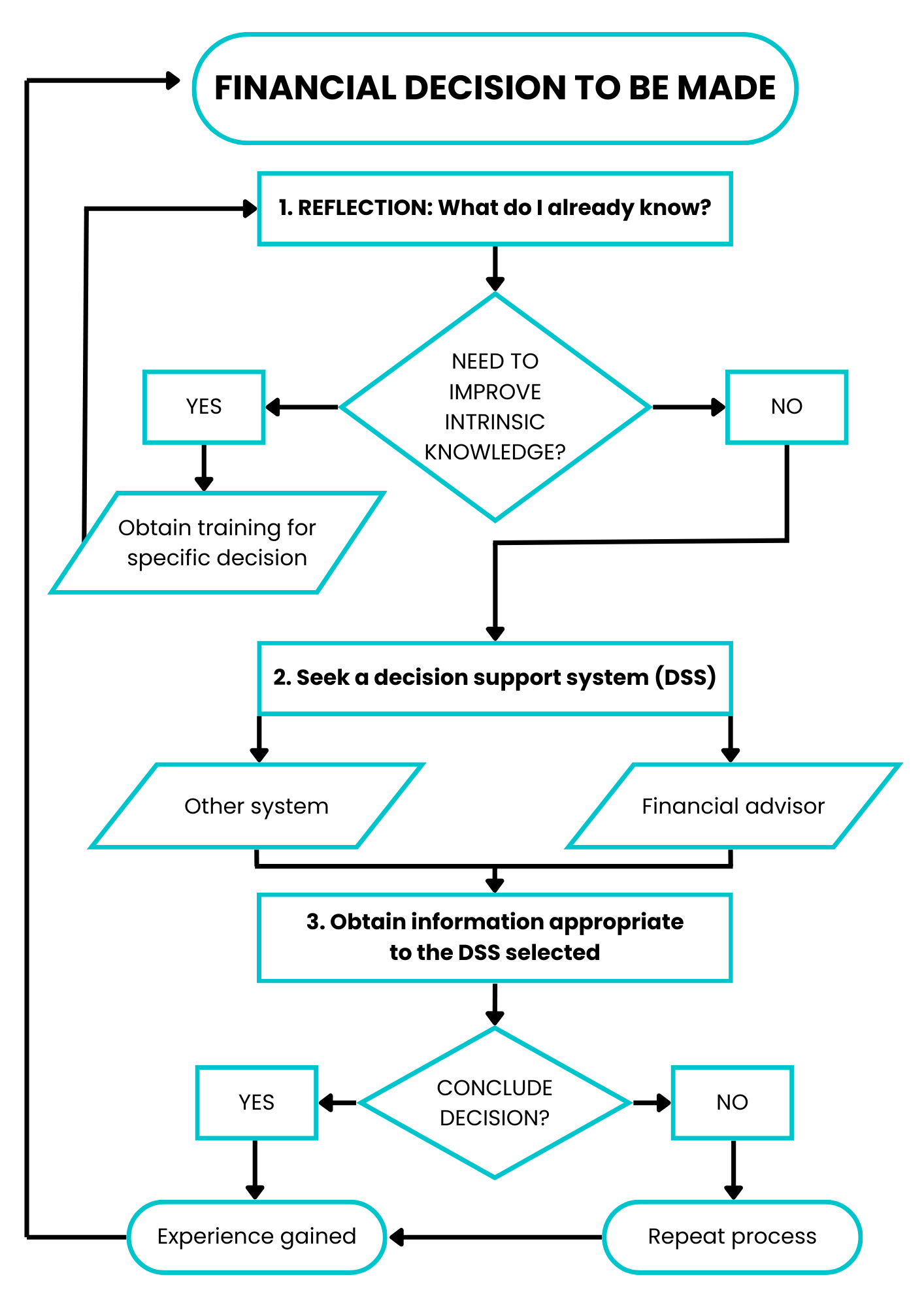

Shreeya was trying to develop a framework to assist planners with bias mitigation generally. Let’s go through that framework.

I did an immense amount of reading for my PhD because there is such a legacy, a volume of different efforts in the academic literature to solve many different biases. And what we really tried to do was then stitch together in a singular cohesive logical model, how to debias someone.

The first step that we came to when doing this research is actually starting with a reflection on what do I know as the investor? And the reason we prompt the self-reflection, is because experience is such a powerful teacher.

In the literature, they did a study around students that actually have experience with debt. And they found that those students that have experiences with actually dealing with debt, managing with debt, actually better understood the effect of compound interest and were less susceptible to the hyperbolic discounting bias.

So, experience as a very powerful teacher is the first point in bias mitigation. Can you actually think about and reflect on for this financial decision I’m about to make, do I have any historical experience?

But experience is a double-edged sword as well, right? Because there’s also research that shows that investors with too much experience may actually exacerbate their inherent overconfidence, which we know is pretty problematic when it comes to making our financial decisions.

So, taking a step back, step one is what do I know? If I don’t know enough, what am I going to do about it? Is there a need to then improve my intrinsic knowledge? If the answer is yes, then we then encourage investors to go ahead and obtain some specific training for the decision that they are about to make, the current decision that they are having to confront themselves with.

Here’s a picture of the framework which is published in the International Journal of Consumer Studies. Feel free to share far and wide in your teams.

If you don’t need to improve your knowledge, the next step is to go ahead and seek what we called a Decision Support System (DSS). And a DSS could either be something digital or it could be a person. Ultimately, you need something to help you make that decision.

When I say a digital tool, it could be some investment software, some platform that helps you look at your information maybe quantitatively and qualitatively. So maybe looking at some pictures or the numbers, trying to help you make that decision. Another DSS is something we are very fond of and that’s actually seeking out a financial planner. So, using the financial planner as a platform or a method to help you reach a decision. So, helping support you in making that decision.

Success in investing doesn’t correlate with IQ … what you need is the temperament to control the urges that get other people into trouble in investing.

Now, depending on the decision support system that the investor ultimately settles on, they would then need to obtain appropriate information, particular to the decision support system. I guess if you use a financial advisor, you’d have to provide them with the requisite information to help you make that decision. If you’re using some form of computer software or some computer system, you’d need to then go ahead and seek out that historic and future looking type of data to basically give yourself the required inputs in feeding through the data through that decision support system.

And that high level will help you conclude on your decision. And once you’ve concluded on your decision, the funny thing is that you’ve then actually created experience for yourself. So, you’ve learned some lessons by going through this whole process. So, when you make your next financial decision and you’re doing that stand back test around, do I have the experience to make this decision? Hopefully you do. So, it’s a circle, it’s a self-fulfilling model almost…

Shreeya’s framework for bias mitigation emphasises self-reflection, knowledge acquisition, and decision support systems. By understanding one’s biases and seeking appropriate guidance, investors can make more informed decisions. This iterative process fosters experiential learning and empowers individuals to navigate the complexities of financial decision-making.

To become a successful investor, you must have the discipline and patience to avoid the emotional highs and lows that can lead to costly mistakes.

Home bias presents a formidable challenge in investment decision-making, but with awareness and strategic interventions, its impact can be mitigated. By incorporating insights from behavioural finance and adopting proactive measures, investors can transcend cognitive biases and build resilient portfolios.

And that’s exactly what we’re going to unpack in the next episode. We’ll be sharing tips (and speaking to the best expert there possible is on this topic) to help you assess and ensure you have a truly diversified investment portfolio. Keep your eyes peeled…

Narrow framing – Narrow framing, the compromise effect, glossing, and the enabling frame. We need frames to make sense of the world. But they cause problems.

The anchored trader – Anchors tie us down and can have serious consequences for investors and traders. Don’t be the anchored trader.

Share your answers in the comments below.

I am passionate about helping people understand their behaviour with money and gently nudging them to spend less and save more. I have several academic journal publications on investor behaviour, financial literacy and personal finance, and perfectly understand the biases that influence how we manage our money. This blog is where I break down those ideas and share my thinking. I’ll try to cover relevant topics that my readers bring to my attention. Please read, share, and comment. That’s how we spread knowledge and help both ourselves and others to become in control of our financial situations.

Dr Gizelle Willows

PhD and NRF-rating in Behavioural Finance

Receive gentle nudges from us:

[user_registration_form id=”8641″]

“Essentially, all models are wrong, but some are useful.” – George E.P. Box