You need to buy an annuity when you retire. And generally, the choice when doing that is between a living annuity and a guaranteed annuity. With a living annuity, you maintain ownership of the money, but you need to monitor your drawdown percentage and ensure that the money lasts for as long as you live. With a guaranteed annuity, you give your retirement savings to an insurance company but then they guarantee you an income for the rest of your life. But, did you know that you can actually do a combination of the two? It’s called a blended annuity.

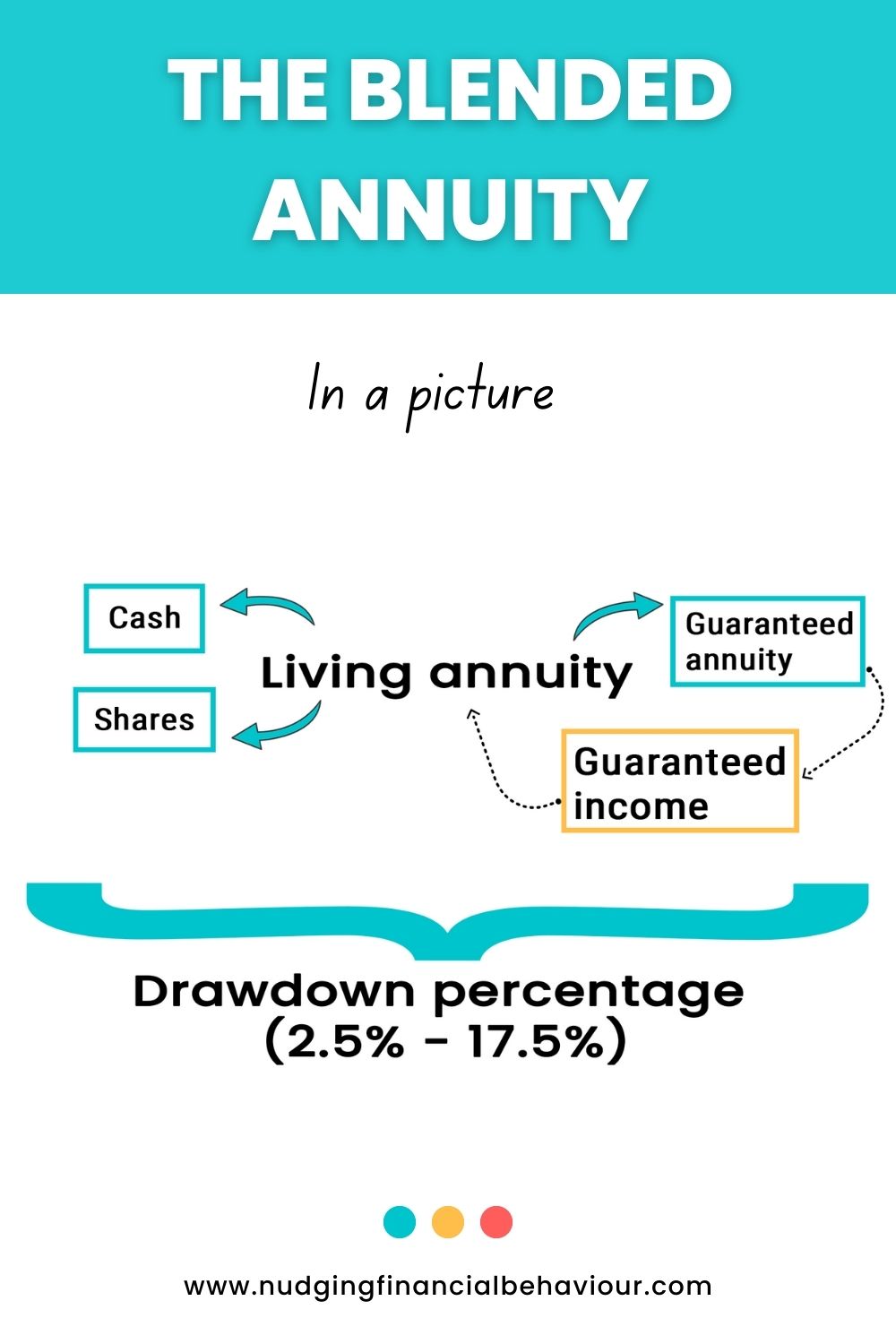

Remember that a living annuity is an investment vehicle. It takes your retirement money and invests in different things… shares, cash etc. When you have what’s called a blended annuity, one of the things your living annuity invests in is a guaranteed annuity.

You already know that with a living annuity, you select a drawdown percentage (between 2.5% and 17.5% remember?) and you withdraw an income from your living annuity each month. But the risk with a living annuity is that you start eating into your capital and then the income you withdraw isn’t enough to cover your expenses.

Now if you remember the characteristics of a guaranteed annuity carefully, you’ll recall that it pays you an income for life, guaranteed. This means that there’s an amount being paid out of the guaranteed annuity into the living annuity. Forever. So – there will always be something to withdraw.

The general thinking with this blended option is that you need to determine what your essential expenses are. Typically, this would be the cost of housing, food and medical expenses. If you can figure out what this costs you, you can then set up your blended annuity so that these costs are covered by the guaranteed portion. Then you know that no matter what happens, your essential expenses are covered.

Get the appropriate advice and consider all the options available to you before you make your decision…. If you want a recap of everything we’ve covered in this series, stay tuned for the final post. It’s going to bring everything together!

If you haven’t done so yet, subscribe to our YouTube channel.

I am passionate about helping people understand their behaviour with money and gently nudging them to spend less and save more. I have several academic journal publications on investor behaviour, financial literacy and personal finance, and perfectly understand the biases that influence how we manage our money. This blog is where I break down those ideas and share my thinking. I’ll try to cover relevant topics that my readers bring to my attention. Please read, share, and comment. That’s how we spread knowledge and help both ourselves and others to become in control of our financial situations.

Dr Gizelle Willows

PhD and NRF-rating in Behavioural Finance

Receive gentle nudges from us:

[user_registration_form id=”8641″]

“Essentially, all models are wrong, but some are useful.” – George E.P. Box