We’ve reached the end of this series! We hope we’ve succeeded in providing you with all the information you need to make the best decisions with your retirement money. This post is to cover some key points to make super sure you understand all your retirement options.

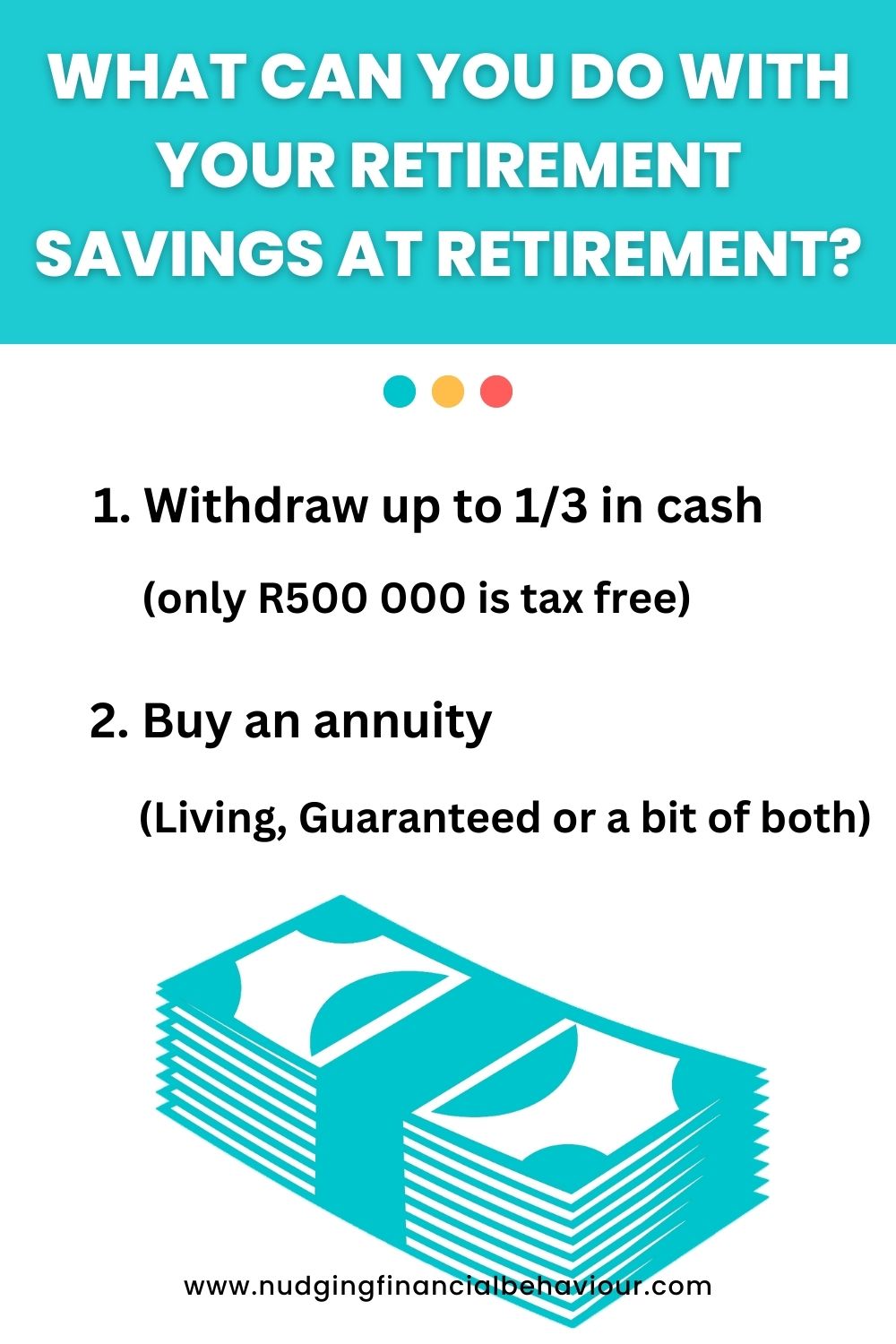

First – you can withdraw up to 1/3rd of your retirement savings in cash at retirement date (maybe a bit more if you’ve got a provident fund rather than a retirement fund or pension fund). The first R500k of that is tax free. Anything above that you’re going to pay tax on.

Next – you need to buy an annuity. Is it Living? Is it Guaranteed? Or is it a bit of both?

With a Living Annuity, you retain ownership of that money. But with that comes some responsibility. You need to ensure you maintain a safe drawdown percentage. Usually that’s somewhere between 4 and 5%. If you can do that, then provided the markets don’t do anything too crazy, your money should last a long time.

With a Guaranteed Annuity, you give your retirement savings to an insurance company and in return, they pay you an income for the rest of your life.

The right outcome for you is dependent on many things: how much money you have saved, how much your expenses are, how much discipline you have with your money, how healthy you are, your lifestyle, your financial circumstances, and whether you need to leave money for your financial dependents. But fortunately that’s why there are different options at retirement.

Our advice is that you make sure you get quotes for each of the options we’ve discussed in this series from more than one product provider. Then, consider them in light of your own personal circumstances.

Remember that retirement is meant to be some of your best years. You deserve them after all the years you’ve been working! Let’s ensure that you’re equipped to make decisions that will give you the best income to sustain you in your retirement. Remember – this is YOUR retirement money!

I am passionate about helping people understand their behaviour with money and gently nudging them to spend less and save more. I have several academic journal publications on investor behaviour, financial literacy and personal finance, and perfectly understand the biases that influence how we manage our money. This blog is where I break down those ideas and share my thinking. I’ll try to cover relevant topics that my readers bring to my attention. Please read, share, and comment. That’s how we spread knowledge and help both ourselves and others to become in control of our financial situations.

Dr Gizelle Willows

PhD and NRF-rating in Behavioural Finance

Receive gentle nudges from us:

[user_registration_form id=”8641″]

“Essentially, all models are wrong, but some are useful.” – George E.P. Box