Did you know that the order of information presented to you influences your working memory? It’s known as serial position effects. Said more simply: items presented first get first dibs on your short- term memory. But the last item on the list? That one needs some time to work in its favour. What am I talking about? I’m talking about primacy and recency effects.

Let’s say you have a date lined up, but you need to choose between two people who’ll accompany you…

The first date option is envious, stubborn, critical, impulsive, good-looking, and intelligent.

The second date option is intelligent, good-looking, impulsive, critical, stubborn, and envious.

Who would you pick to go on the date with you?

Are you picking option 2? Most people do.

However, did you notice that both people were described with identical words. They were just in a different order.

Arguably, one of the oldest experimental psychology studies was performed by Solomon Asch in 1946. He did exactly what the above example does: asked participants to rate people based on a collection of words (some positive, some negative). Results showing that participants rated the person with positive characteristics at the start of their description higher than those whose positive characteristics came at the end of their description.

Primacy effect is defined as our tendency to better remember facts, impressions, or tasks that are presented first, rather than those presented later in a sequence. Share on XMore commonly, in social contexts, you can call it the first-impression bias.

It’s not an old-wives-tale, first impressions do matter. You’ll remember the first time you meet someone, more so than the 2nd and 3rd encounters, primarily because of the primacy effect.

You never get a second chance to make a first impression.

This is why any interview checklist will tell you not to arrive late. It doesn’t leave a good first impression. You’re not doing yourself any favours. Once recruiters reflect on your interview and application, they’re likely to remember that you came late more than anything else. Dressing too casually or having grammar and spelling mistakes on your application form are similar examples of things NOT to do. Creates a bad first impression.

But why? It’s because of how our human memory responds to primacy and recency effects.

Do you only remember the first few things at the top of a grocery list? You’re not alone.

It takes less processing power for our brains to practice and free recall a single item (the first item on the list) than multiple items (all the items after that first item and including that first item). Research has shown that when we read a series of statements, the amount of time we spend reading each statement declines with every new piece of information. Thus, it is no surprise to hear that we are more susceptible to primacy effect when we are tired and distracted (compared to when we are wide awake and pay attention).

Do you only remember the first few things at the top of a grocery list? You’re not alone.

It takes less processing power for our brains to practice and free recall a single item (the first item on the list) than multiple items (all the items after that first item and including that first item). Research has shown that when we read a series of statements, the amount of time we spend reading each statement declines with every new piece of information. Thus, it is no surprise to hear that we are more susceptible to primacy effect when we are tired and distracted (compared to when we are wide awake and pay attention).

The impact of primacy effect has far-reaching implications. But with the awareness of it, you can subtly make it work in your favour.

Consider you’re in a meeting and there’s a point on the agenda upon which a decision needs to be made. The first opinion that is heard will likely influence everyone’s assessment. Thus, if you have an opinion, make it first, and influence your colleagues in that direction (nudge, nudge).

But, if you are chairing the meeting, ensure that you take opinions in a random order so as not to give anyone an unfair advantage. (You’re all thinking of that person that talks first in meetings now, aren’t you? If not… that person might be you!)

The impact of primacy effect has far-reaching implications. But with the awareness of it, you can subtly make it work in your favour.

Consider you’re in a meeting and there’s a point on the agenda upon which a decision needs to be made. The first opinion that is heard will likely influence everyone’s assessment. Thus, if you have an opinion, make it first, and influence your colleagues in that direction (nudge, nudge).

But, if you are chairing the meeting, ensure that you take opinions in a random order so as not to give anyone an unfair advantage. (You’re all thinking of that person that talks first in meetings now, aren’t you? If not… that person might be you!)

Several studies have examined this bias in elections. Time and again, the candidate who is listed first, implying that they appear first online and any associated material on them is made available first, were more likely to win the vote than the other candidates. Politicians who open a debate with a strong argument are more likely to have their message get across than those that are heard in the middle of the debate.

For those of you that like to run polls on LinkedIn, perhaps consider the order of response options next time? I can assure you – marketers are using this cognitive psychology bias against you all the time!

Several studies have examined this bias in elections. Time and again, the candidate who is listed first, implying that they appear first online and any associated material on them is made available first, were more likely to win the vote than the other candidates. Politicians who open a debate with a strong argument are more likely to have their message get across than those that are heard in the middle of the debate.

For those of you that like to run polls on LinkedIn, perhaps consider the order of response options next time? I can assure you – marketers are using this cognitive psychology bias against you all the time!

When releasing a new product, marketing departments take advantage of the primacy effect by curating something known as a ‘launch’. It usually includes a bit of pre-promotion (ensuring that the first thing you hear about the product is all good stuff) followed by the theatre-like extravaganza of the official launch. Thus, they control the message and design the perfect first impression. Think: Apple, Tesla…

If retailers (particularly the online players) want you to click on something, they’ll put it first. It doesn’t matter if the list is top-to-bottom or left-to-right, and (usually) it doesn’t really matter if you can see the whole list or if you’re only seeing one item at a time. If you’re being nudged to click, the item will be first on the list.

When releasing a new product, marketing departments take advantage of the primacy effect by curating something known as a ‘launch’. It usually includes a bit of pre-promotion (ensuring that the first thing you hear about the product is all good stuff) followed by the theatre-like extravaganza of the official launch. Thus, they control the message and design the perfect first impression. Think: Apple, Tesla…

If retailers (particularly the online players) want you to click on something, they’ll put it first. It doesn’t matter if the list is top-to-bottom or left-to-right, and (usually) it doesn’t really matter if you can see the whole list or if you’re only seeing one item at a time. If you’re being nudged to click, the item will be first on the list.

Primacy effect has some competition. Consider a study by Miller and Campbell where participants were presented with two arguments in a trial. One argument was for the plaintiff accused of a crime, and the other argument against. In some of the trials, the order of the arguments was switched. And in other trials, there was a delay in time between hearing the two arguments.

Consider that the first argument was for the plaintiff and the second against.

When there was no delay between the first and second argument, the participants voted in favour of the plaintiff (primacy effect). That’s the power of opening statements right there.

However, when there was a delay between the first and second argument, the participants voted against the plaintiff. Introducing – the recency effect.

Contrasting to the primacy effect is the recency effect.

Recency effect refers to how we place too much emphasis on current experiences or situations and not enough on long-term historical patterns. Share on XThe more recent information is, the more likely we’ll be able to remember it. That gives the last items on the list a fighting chance!

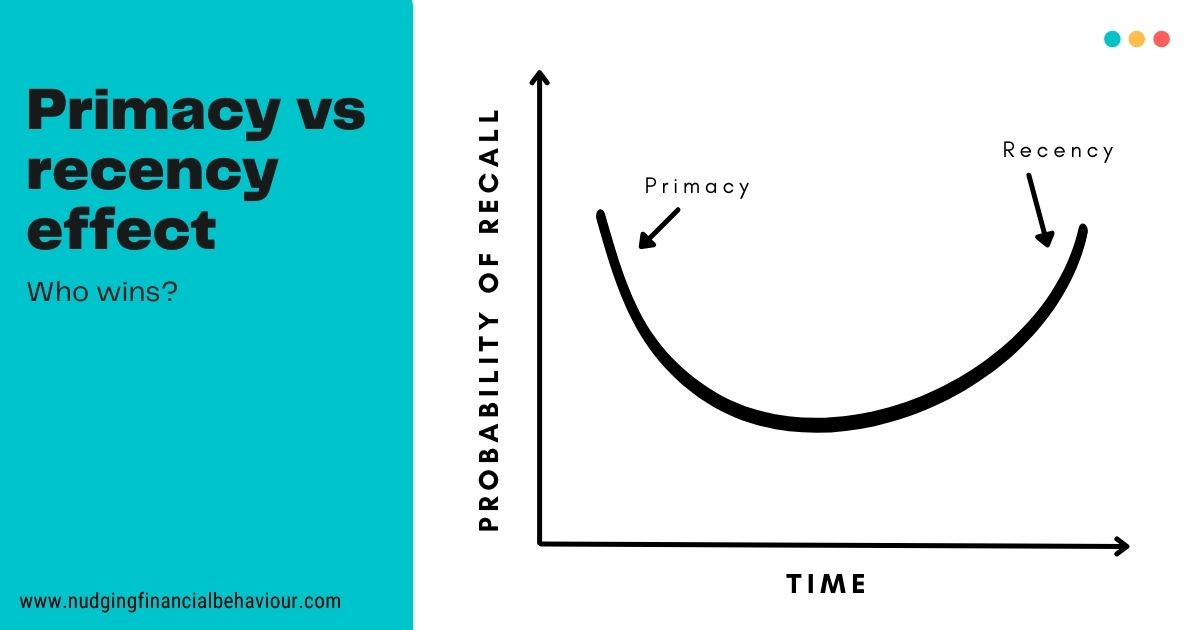

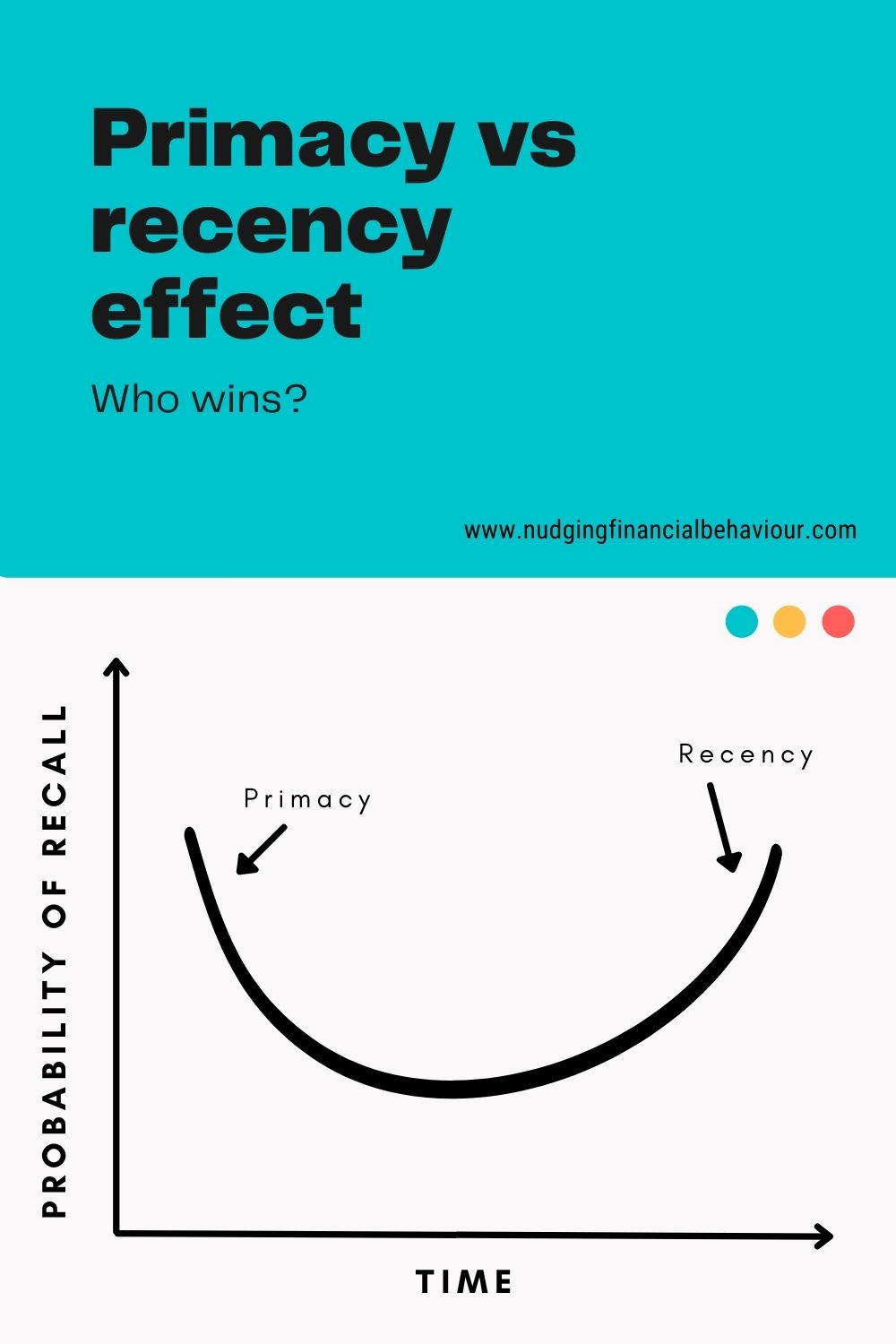

In a fight between primacy effect and recency effects, who would win? Generally, if you have to make an immediate decision based on sequential observations (consider the characteristics of that potential date, or the opinions in the meeting) then the primacy effect dominates. But if the observations were some time ago, the recency effect carries more weight. If you watched a Netflix series a few months ago, you’re more likely to remember how it ended, than the first episode.

Of course, it’s important to always remember that the status quo will often trump any choices and the compromise effect can also have a powerful influence. But these biases do have an element of interplay.

Recency bias creates a lot of problems in our investment decisions, and it’s a difficult bias to overcome. To not focus on recent events that you’ve experienced is a tough ask. But the problem arises when we start taking new information and overwriting old memories with it.

A perfect example of this is the trading behaviour that is seen when a negative shock (such as the pandemic or the current geopolitical tension) hits the financial market. Because prices are falling, many investors panic. This results in a combination of sales and adjustments to investment approaches i.e., more in cash which is safer. What is risky about this is that situations don’t carry on forever. There’s nothing wrong with reassessing your investment approach in light of a change of events but be careful that you’re not being influenced by a recent occurrence that might not be sustained.

Recency bias creates a lot of problems in our investment decisions, and it’s a difficult bias to overcome. To not focus on recent events that you’ve experienced is a tough ask. But the problem arises when we start taking new information and overwriting old memories with it.

A perfect example of this is the trading behaviour that is seen when a negative shock (such as the pandemic or the current geopolitical tension) hits the financial market. Because prices are falling, many investors panic. This results in a combination of sales and adjustments to investment approaches i.e., more in cash which is safer. What is risky about this is that situations don’t carry on forever. There’s nothing wrong with reassessing your investment approach in light of a change of events but be careful that you’re not being influenced by a recent occurrence that might not be sustained.

The primacy effect is valuable. It helps us to remember the importance of first impressions. But be careful of making unfair comparisons. Evaluate things impartially. Consider how the order of candidates, questions, and reviews influence your relative decisions.

Be careful of assigning a heavier weight to the more recent information you have, rather than older data. The market will not always look the way it looks today. Don’t make unwise decisions because of where the market finds itself at a point in time.

Also, it’s worth mentioning that the jury is still out regarding the impact of primacy and recency effects in verbal learning. When you’re reading – definitely! But when you’re listening, there is an argument to say that verbal behaviors differ. And perhaps, recency trumps primacy!

Let us know in the comments on primacy and recency effects below.

I am passionate about helping people understand their behaviour with money and gently nudging them to spend less and save more. I have several academic journal publications on investor behaviour, financial literacy and personal finance, and perfectly understand the biases that influence how we manage our money. This blog is where I break down those ideas and share my thinking. I’ll try to cover relevant topics that my readers bring to my attention. Please read, share, and comment. That’s how we spread knowledge and help both ourselves and others to become in control of our financial situations.

Dr Gizelle Willows

PhD and NRF-rating in Behavioural Finance

Receive gentle nudges from us:

[user_registration_form id=”8641″]

“Essentially, all models are wrong, but some are useful.” – George E.P. Box